If you were born between 1946 through 1964, you’re a Baby Boomer.

You’ve contributed to your employers 401k plan for 15-30 years. Though a few hundred grand seems like a lot of money to most, imagine you’re 52 and you have around $3-500,000 in your 401k.

What I’m trying to tell you is there’s a virus in your retirement plan. It’s called a 401k, sometimes an IRA. It will not get you to retirement. It’s a virtually inevitable that it will fail. Don’t believe me? Do your research and evaluate the statistics and I’m confident you’ll be convinced that you’ll come to the same conclusion. The average return for the typical American employee’s 401k the last two decades is less than 3.5%.

What can you do now?

Option (1) Save more money.

Option (2) Look for and invest for a higher return.

I’m going to assume that you’re already focused on option (1), so we’ll focus on option (2). So, how can you invest your 401K or IRA to obtain higher returns. I would suggest rolling your 401k over to an IRA then setting up a self-directed IRA to invest your money where you can obtain higher returns at low-risk. There is a reason that banks more easily lend on real estate and at lower rates than businesses. It’s because they’re confident that investing in real estate will be profitable.

What is a self-directed IRA?

Most IRAs are typically invested in stocks, bonds and mutual funds. With a self-directed IRA from, as the name implies, you make the investment choices. The types of investments are virtually unlimited.

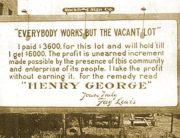

You can invest in real estate to improve the returns of your retirement account. These investments are backed by properties that have innate value (their not making any more of it).

If I’ve been describing you (above), with a $350-500,000 401k balance at 52 years old, you can likely generate a retirement income from real estate using just $175-250,000 — 2-5 times what you’ll end up with if you continue investing in your company 401k or IRA with twice the money. In fact, given that range of beginning investable capital, you’ll likely be able to generate a retirement income anywhere in the range of $55-74,000 a year — using real estate as your vehicle.

Learn more and get started by clicking the button below and completing the brief questionnaire:

________________________________________________________________________________________________________________________

Alegria Capital Management is a real estate investment management company that manages funds invested in quality residential real estate in high-growth markets nationwide.

Leave A Comment