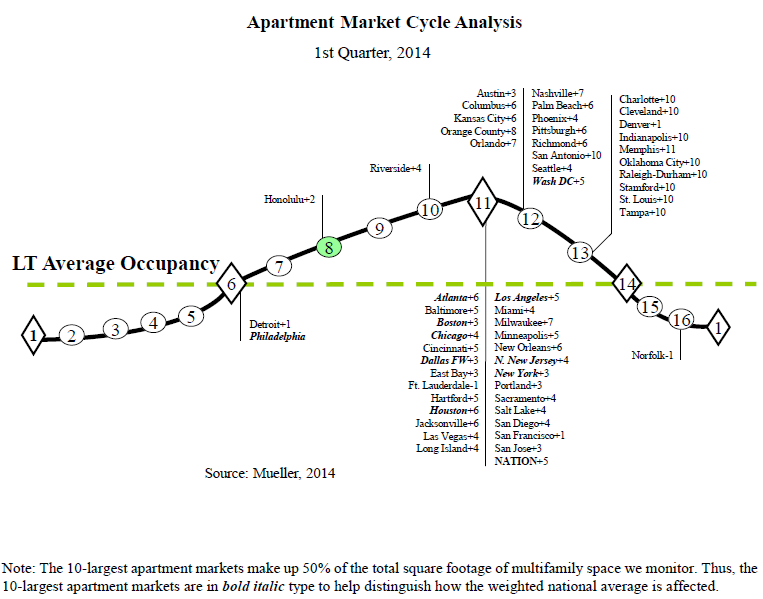

One of my favorite reports, which I’ve used for years is produced by Dr. Glenn Mueller of Dividend Capital. Is he credible? With over 35 years of real estate industry experience, Dr. Mueller is not only the foremost expert on market cycles in the United States, but he is also a professor at the Burns School of Real Estate and Construction Management at Denver University one of the oldest and largest real estate programs in the country. He has also testified in front of Congress in regard to real estate market cycles!

(See his full bio here: http://daniels.du.edu/faculty-staff/glenn-mueller/)

Everyone says that nothing is a sure thing except death and taxes, but I would like to add one more… market cycles. All real estate markets move in cycles. Although they are correlated, each property type (industrial, apartment, office, retail) move in separate cycles (ex. Apartment market might be at a peak and industrial might be entering a recovery).

Real Estate Cycles 101:

Real estate market cycles include four quadrants. Here’s a brief description:

(1) Recovery: Negative rent growth; Below inflation rental growth. As prices start to rise, it begins to be profitable for developers to develop new properties. Here demand is high, but there is not sufficient supply to meet this demand. Once a recover is identified is when institutional investors generally start to invest. You saw this happening in late 2011 to 2013.

(2) Expansion: Rents rise rapidly toward new construction levels; High rent growth in tight market. At the end of the expansion phase a peak is reached where there is demand and supply equalibrium.

(3) Hypersupply: Rent growth positive, but declining. Here supply is high and demand is low, so prices fall. Developers stop developing as it is no longer profitable.

(4) Recession: Below inflation and negative rent growth. Demand has fallen and at the bottom of the recession period demand meets supply. As the end of the recession period is generally when individual investors start buying as they are willing to take on more risk than institutional investors. You saw this happening in 2010 and 2011.

This market cycle monitor is just one source of market information. Wise investors evaluate many reports and sources of information to develop a market opinion, including population growth and job forecasts, trend analysis, development, vacancy rates, etc.

My Personal Market Cycle Observations:

Based on this market cycle monitor and my personal observations in the markets that I currently operate in, here are my observations:

San Francisco: 12 months from a PEAK (end of expansion phase), although the impact of tech growth is unprecedented and may stretch the cycle out… maybe 24 to 36 months from a true peak. Techies moving to the Bay for well-paying jobs are continuing to push up prices and rents.

Dallas/Ft Worth: 12-24 months from a PEAK, although a great market to be in for the long-term. DFW has done fantastic at attracting both population and jobs into the area.

Austin: 12 months from a PEAK, although a great market to be in for the long-term, particularly due to the growth in the tech industry here. Austin is one of the most affordable tech cities and “Silicon Hills”, as locals call the tech industry here, will be competing against Silicon Valley (San Jose) and Silicon Forest (Portland) and Seattle for tech companies and talent.

San Antonio: 12-24 months from a PEAK. Prices and rents have risen briskly over the last 12 months. And days on market are very low. This is a stable market, due to its robust healthcare and aerospace industries, with great long-term potential.

Charlotte: Now in EXPANSION; 36 to 48 months from a peak. Queen City has lots going for it. It’s the 2nd largest banking and has been attracting companies and significant population from New York and other more expensive markets on the East Coast for its great culture, low cost of living, and lower cost of doing business.

Agree or disagree with my personal analysis?

Please post your comments below. I’d love to hear from you.

—————————————————————————————————————————————-

Jon Strishak is founder of Alegria Capital Management, a residential real estate investment management company that invests in high-growth developing U.S. markets nationwide. These are cities that are affordable, are expanding at a rapid pace, have a great mix of job diversity and culture, and have tremendous population and job growth. To learn more, please visit www.alegriacm.com

Leave A Comment